Local Governments - Exclusive — 09 December 2013

By Ed Mendel.

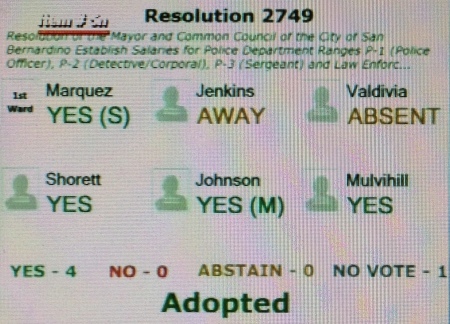

Following the city charter, a reluctant San Bernardino city council last week approved a police pay raise costing about $1 million, the second $1 million police salary increase since the city filed for bankruptcy last year.

The four council members who voted for the 3 percent pay hike all criticized a city charter provision linking San Bernardino to the average police pay in 10 other cities, most much wealthier with higher per-capita income.

When a pay hike was approved last March, the city attorney, James Penman, and a councilman, Robert Jenkins, argued competitive pay attracts quality officers to combat a high crime rate. Penman was recalled last month, and Jenkins was not re-elected.

“I think most residents are puzzled and outraged that we are compelled during bankruptcy to provide substantial pay increases,” a newly elected councilman, Jim Mulvihill, said last week. “Not only that, it’s not any negotiation within our community.”

Several groups pushed to repeal the charter provision after the bankruptcy. But the city council chose not to put a repeal measure on the ballot last month, citing short timelines and ballot costs, the San Bernardino Sun reported.

After Vallejo filed for bankruptcy in May 2008, a split vote of the city council (called “insane” by a council member elected later) gave police a 7 percent raise that took effect in July 2010, more than a year before the city exited bankruptcy.

Now Vallejo has a $5.2 million general fund deficit projected to grow to $8.9 million next year. Critics say Vallejo failed to make structural budget changes needed for long-term solvency, such as curbing pension and retiree health care costs.

San Bernardino cut short-term pension costs. In danger of not making payroll, the city filed an emergency bankruptcy on August 1 last year, then took the unprecedented step of halting payments to the California Public Employees Retirement System.

Before resuming payments in July, CalPERS said the city ran up a debt of about $17 million. The big pension system, fearing other struggling cities may skip payments, is appealing a ruling that San Bernardino qualifies for bankruptcy.

U.S. Bankruptcy Judge Meredith Jury directed San Bernardino to prepare an outline or “term sheet” of its debt-cutting proposal for mediation with creditors conducted by retired U.S. Bankruptcy Judge Greg Zive of Reno.

Mayor Patrick Morris told the city council last week that the first two-day mediation session was held the previous week in Reno. He said the next session is scheduled for January, followed by another in February.

“I think it’s fair to say progress is being made, and that’s about all we can say,” said Morris. He said the judge has placed a “gag order” on the city’s debt-cutting proposal and the mediation.

Webcast of San Bernardino City Council vote on pay raise

All that San Bernardino officials have publicly proposed about pensions may be in a plan last fall for operating in bankruptcy: A “fresh start” to “reamortize CalPERS liability over 30 years,” perhaps realizing “value of $1.3 million per year.”

San Bernardino may or may not have a stronger hand in negotiations after U.S. Bankruptcy Judge Steven Rhodes said last week that Detroit pensions can be cut in bankruptcy, the first clear ruling of its kind.

Morris told the Riverside Press-Enterprise the Detroit ruling is another “arrow in the quiver of cities who are in desperate circumstances,” such as San Bernardino. He said the city’s intent is to be fair to retirees and respect pensions as best it can.

“The question always is what is fair,” Morris told the newspaper. “What is fair has to be put up against the question of affordability. What is fair and what is affordable may be two different numbers.”

CalPERS contended the Detroit ruling on a city-run retirement system does not apply to CalPERS, because it’s an “arm of the state” carrying out state policy in a “three-way relationship” with local governments and their employees.

“The Bankruptcy Code is clear that a federal bankruptcy court may not interfere in the relationship between a state and its municipalities,” CalPERS said last week. “The ruling is not applicable to state public employee pension systems like CalPERS.”

A San Bernardino Police Officers Association website published the CalPERS statement under the headline: “Detroit Ruling Unlikely to Affect San Bernardino pensions.”

The CalPERS position, a state agency waging an all-out legal battle against San Bernardino, is echoed by the state finance department and state controller. They are suing to withhold $15 million in tax revenue from the bankrupt city in a separate dispute.

A report issued by the Pew Charitable Trusts in July, “The State Role in Local Government Financial Distress,” said a number of state do not share the California tradition of not helping local government fix broken finances.

Some states do not allow municipal bankruptcies. Some such as Michigan appoint emergency managers (despite a rejection of emergency managers by voters) to make the tough decisions. And some monitor local governments to prevent financial failures.

“North Carolina, despite high unemployment, has managed to escape serious local government budget problems in part because of its strong centralized system of monitoring and oversight,” said the Pew report.

California created an “elaborate fiscal oversight system” for school districts, said the report, because the state provides much of school funding. The state can appoint an administrator for daily school district operations and issue emergency loans.

“The most recent was $55 million to the Inglewood schools in suburban Los Angeles, a victim of declining enrollment, cuts in state aid, and ill-advised financial decisions,” the report said. “State officials warn that more takeovers are possible in similarly troubled school districts.”

State aid helped a Rhode Island city with 19,0000 residents, Central Falls, emerge from bankruptcy last fall in record time, 13 months. Retirees agreed to pension cuts of up to 55 percent, with no one getting less than $10,000.

The pension cut was softened by a five-year supplement from the state. The city’s bondholders got reassurance from the state, which passed legislation giving them the right to place liens on tax revenue.

In California, a bankrupt San Bernardino not only battles state agencies, but part of its financial problem is the “affordability” of high pension costs resulting from a trendsetting CalPERS-sponsored state pension increase, SB 400 in 1999.

Vallejo officials said they considered an attempt to cut pensions in bankruptcy, but chose not to try after a deep-pocketed state agency, CalPERS, threatened a long and costly legal battle.

No comments:

Post a Comment