Here’s How We Can Force Congress To Read The Bills They Vote On…

How to deal with this reality, which has been many years in the making, is a difficult challenge.

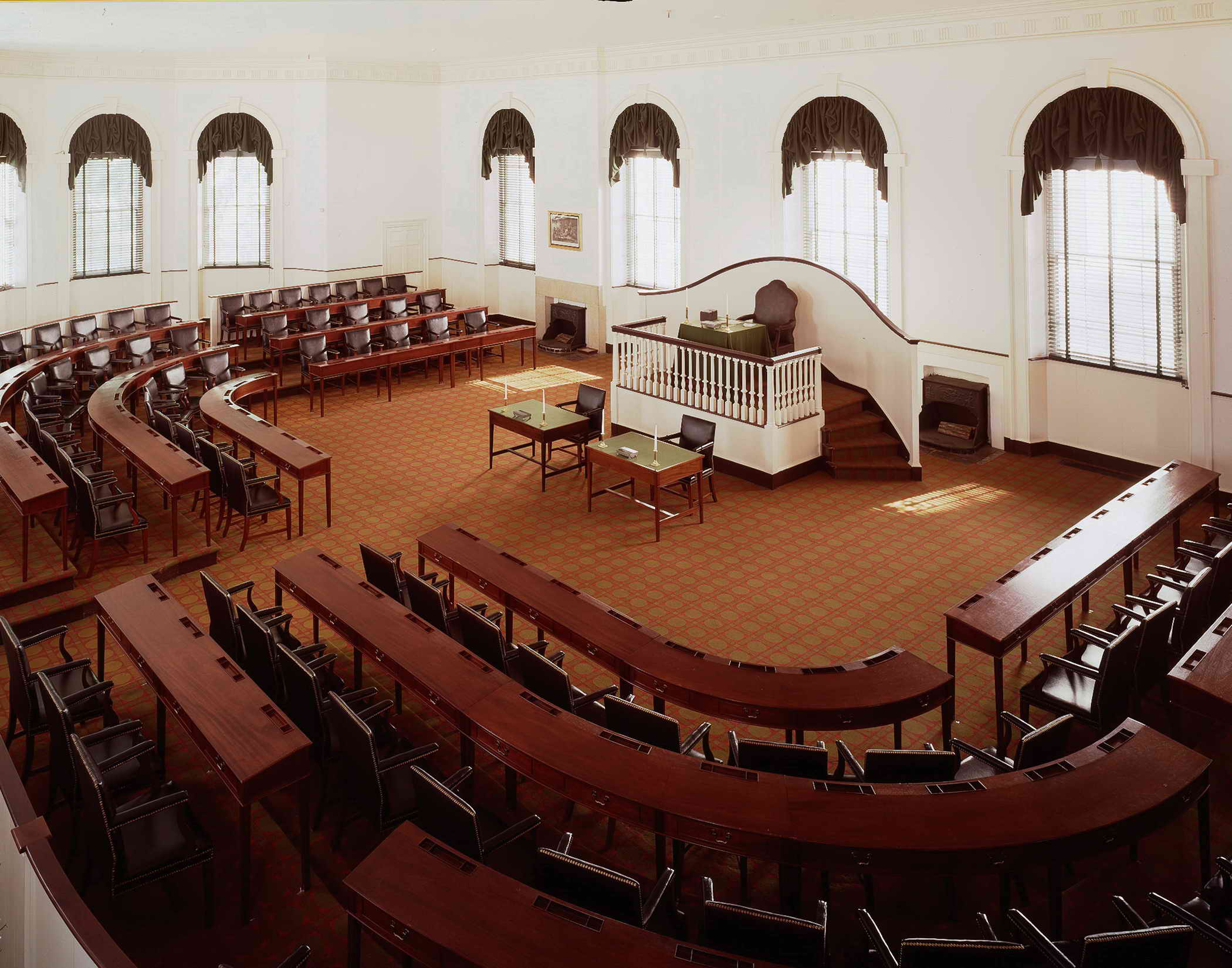

ALEXANDRIA, VA — In mid-January, Congress rushed

through a massive spending bill of 1,582 pages; the accompanying

explanatory statements added another 1,278 pages. It was voted on only

44 hours after it was posted, giving members of Congress less than a

minute to read each page — if they gave up a night’s sleep.

When asked whether he read this $1.1 trillion bill, Rep. Earl

Blumenauer (D-OR) was honest. He responded, “Nobody did.” This bill will

fund the federal government for the rest of fiscal year 2014, which

ends September 30, 2014. The bill increases federal spending by $44.8

billion this year over the spending level previously set by Congress.

How many members of Congress know that this bill gives the oil and

nuclear industries $154 million more than the Energy Department

requested for nuclear energy, and $141 million more than requested for

fossil-fuel development? How many are aware that the bill skirts a ban

on earmarks by providing more than $44 million for the Army Corps of

Engineers that the administration had not requested — or that the

Pentagon was given $666 million to study illnesses such as breast cancer

that have little to do with matters of national defense? The list of

what members of Congress do not know is in the bill is a long one.

None of this is new. In 2010, Congress passed, and President Obama

signed, the Dodd-Frank Wall Street Reform and Consumer Protection Act.

At 2,319 pages, it is significantly longer than previous financial

reform laws and approaches the extraordinary length of the Affordable

Care Act. By comparison, the Federal Reserve Act of 1913, which

established the Federal Reserve banking system and the single national

currency, was 31 pages long. The Glass-Steagall Banking Act of 1933,

which overhauled the entire banking system in light of hundreds of bank

failures, was 37 pages long.

The complexity in legislation has created an industry of lobbyists

and consultants — often former members of Congress and former

congressional staff members — to help individuals and businesses to cope

with what has been imposed upon them. University of London economist

Anthony G. Heyes notes, “It is precisely the complex, opacity, and

user-unfriendliness which underpin the value of their expertise” that

translate into “selling advice to those they previously regulated.”

Peter Schweitzer, president of the Government Accountability

Institute and a senior fellow at the Hoover Institution, tells the story

of Amy Friend, a chief aide to Sen. Christopher Dodd (D-CT) in crafting

the Dodd-Frank financial reform bill and former chief counsel to the

Senate Banking Committee. “After the bill passed,” he writes, “and

became law, she left Capitol Hill and became managing director at

Promontory Financial Group, which describes itself as ‘a premier global

financial consulting firm.’ This Washington-based consulting firm is

headed up by many people like Friend — people who were once responsible

for erecting or interpreting arcane financial regulations in public

service and then joined the group, where they can charge high fees to

help firms interpret and comply with these befuddling regulations….

Banks complain about Promontory’s high fees, which can run up to $1,500

an hour. Eugene Ludwig, the former comptroller of the currency under

Bill Clinton, reportedly makes $30 million a year running Promontory.”

Or consider Daniel Meade, who was chief counsel to the Financial

Services Committee under Chairman Barney Frank (the “Frank” of

Dodd-Frank). Meade left Capitol Hill for Hogan-Lovells, an established

lobbying firm. When Meade arrived, the firm announced that Meade was “a

principal drafts person of substantial portions of the Dodd-Frank Wall

Street Reform and Consumer Protection Act.” The firm explained that

Meade would be “representing financial services entities and other

entities impacted by the regulation of those entities in connection with

a broad range of regulatory and transactional matters, including issues

related to the Dodd-Frank Act.”

John Hofmeister, the former president of Shell Oil, saw the process

at work: “They deliberately write ambiguity into the law. It’s part of a

career-building process. If you are a congressional staffer, you spend

your career crafting complex legislative language. This equips you to

leverage your post-government competence. The whole system builds on

itself.”

“For congressional staffers… it’s a huge payday,” writes Peter

Schweitzer. “Sen. Ron Johnson was first elected to the U.S. Senate in

2010 from Wisconsin. A businessman and entrepreneur, he has hired plenty

of people over the years. When it came to hiring congressional staffers

for his new job, he was struck by a phrase some applicants used during

the interview process: ‘cashing in.’ ‘I had never heard that term before

when hiring someone in the private sector,’ Johnson says. Time spent

working at a lobbying firm or at a consultancy is ‘cashing in.’ Some

people work on Wall Street until they have enough money to ‘cash out.’

In Washington, they set themselves up for those jobs in order to cash

in.”

Alan Siegel, who for many years has advocated greater simplicity in

communications and was called “Mr. Plain English” by PEOPLE magazine,

says, “Complexity robs us of time, patience, understanding, money and

optimism. The U.S. was founded and governed for over two centuries on

the basis of a document that is six pages long. That is 0.1 per cent of

the current income tax code, which currently runs a whopping 14,000

pages.” Even IRS commissioner Douglas Shulman admitted on C-SPAN that he

cannot do his own personal tax return anymore because “it’s just too

complicated.”

Prof. Anthony Heyes believes, “[P]eople working in regulatory

agencies have too little incentive to make or keep procedures and

practices simple, transparent, and user-friendly.” He argues that

one-third of the costs of regulations are “transaction costs”– that is,

“paying someone to help you jump through the ‘hoops and hurdles’ of the

regulatory process.”

One way to simplify legislation and increase the possibility that

members of Congress will read — and understand — the legislation on

which they vote is to adopt a single-subject rule for all bills. Article

III of the Florida Constitution, for example, “requires that every law

shall embrace but one subject and matter properly connected there with.”

It would be good, of course, to require members of Congress to actually

read the bills they are going to vote on. Bills have been introduced

that would require a seven-day waiting period between the time when a

bill is ready for a vote and when the final vote actually takes place.

Others suggest that all bills scheduled for a full vote on the floor be

read out loud. There has even been a suggestion that all members be

required to read the bills before voting — and to sign a legal affidavit

attesting to that fact.

Such proposals may be fanciful considering the reality of today’s

Congress. That we live in a society in which our legislators pass

1,000-bills they have not read and do not understand is beyond question.

How to deal with this reality, which has been many years in the making,

is a difficult challenge. It is one we would do well to confront.

Allan C. Brownfeld is the author of five books, the latest of

which is THE REVOLUTION LOBBY (Council for Inter-American Security). He

has been a staff aide to a U.S. Vice President, Members of Congress, and

the U.S. Senate Internal Security Subcommittee.

The

United Nations has appointed Sarah Palin as a special envoy to Ukraine,

hoping she can help mediate a solution to the growing geopolitical

crisis in that country.

The

United Nations has appointed Sarah Palin as a special envoy to Ukraine,

hoping she can help mediate a solution to the growing geopolitical

crisis in that country.