It

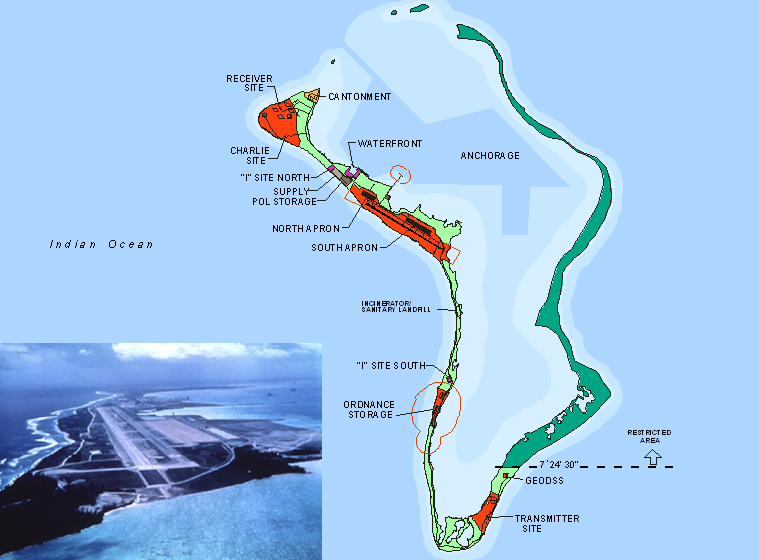

sounds like an expensive cigar, but Diego Garcia is actually a United

States military base that we technically rent from the United Kingdom.

At 967 nautical miles south-southwest from the southern tip of India, it

is more or less midway between Indonesia and the African continent. The

US Navy operates its Naval Support Facility (NSF) there, which is a

naval ship and submarine support base, military air base, as well as a

communications and space-tracking facility.

It also includes a base of operations for the CIA. You’ll note there is no question mark at the end of this article’s title.

Why so few have postulated that this facility may have played a part

in the disappearance of Malaysia Airlines Flight 370 may or may not seem

odd at first blush given the circumstances: I mean, it’s not a secret

base, though clandestine activities conducted there certainly would be.

At any rate, I am told Diego Garcia is the location to which Flight 370

was diverted. My source has actually been to Diego Garcia, and assures

me that you can land a Lockheed C-5 Galaxy there. Those are the military

transport planes they load

tanks aboard, and they’re just about the size of a Boeing 777.

At Diego Garcia, some 20 civilian technical personnel were removed

from the aircraft for interrogation. On March 8, Reuters reported that

20 employees of U.S. chipmaker Freescale Semiconductor were passengers

on Flight 370, according to a statement from the company. It is said

that these employees traveled regularly between company facilities in

Tianjin, China, and Kuala Lumpur. It may be presumed that these

individuals were the same 20 who were reportedly taken to Diego Garcia

for interrogation, although my information holds that the detainees (if

you will) were working in their capacities as contractors.

Reports earlier this week that the flight plan deviation was

programmed into a computer system on board (rather than being executed

manually by one of the pilots was quite accurate), I am told. The

airliner was taken over remotely by US intelligence operatives at the

behest of those at the highest levels of our government.

It has been speculated that the plane was hijacked and the 20 Freescale

Semiconductor engineers kidnapped in order that nefarious parties might

access a revolutionary software package that could prove invaluable to

those in the espionage community. I have been informed that this is not

the case, and here are a couple of reasons I am inclined to believe so:

Whistleblower Edward Snowden was able to purloin thousands of NSA

digital files, distribute them, and escape the country without involving

one other person. I’ve also heard – firsthand – of even more intricate

and dangerous missions being carried out by less than three individuals.

No, there would have to be a great deal more involved than a software

package to commandeer an airliner, kidnap technical contractors, and

then “disappear” the plane and over 200 passengers (who, sadly, were

most likely murdered for the sake of expediency).

The “great deal more” I am told was rather a revolutionary piece of

hardware, not software, and it is not integral to digital data systems,

although it is no doubt used in conjunction with them. The engineers

were part of a joint US-China effort that resulted in one of the most

advanced small gyroscopes for flight ever developed – flight, as in

long-distance space flight.

As you probably know, China has made great strides in the area of

space flight in recent years, and they’re quite proud of it. And

considering the Obama administration’s intentions to devastate America’s

economy, enslave her people, and part out her resources to Russia and

China, a joint US-China space initiative doesn’t seem out of the

ordinary. Why, it’s as American as McDonald’s on a Beijing street

corner, right?

So what went wrong? Well, apparently the DOD got wind that these

engineers (who, despite operating under the auspices of Freescale and/or

other companies, were not American nationals) were on their way to

abscond to China with their prototypes (which were in the cargo hold of

the 777) and other valuable materials, thereby cutting the US out of the

program entirely.

And why not? It’s fairly well-known in the intelligence community

that the Chinese government has absolutely no respect for President

Obama, and his telegraphing weak foreign policy all around the world

wouldn’t lend itself to a sudden changing of his stripes (ineffectual

posturing over Ukraine notwithstanding). Additionally, my understanding

is that China technically owned this technology; the US was aiding in

its development under a partnership, which apparently the Chinese

decided to end in a rather ex parte manner.

The CIA went into action, in concert with the DOD and Boeing

engineers. They commandeered Flight 370 en route, digitally, without the

foreknowledge of the pilots or crew, diverting it to Diego Garcia. I

imagine that’s where the aircraft made that now-infamous and mysterious

turn just northeast of Malaysia.

So essentially, the CIA double-crossed the Chinese before they could double-cross us.

The fate of the airliner is an aspect of this story which was not

made entirely clear. I understand that there is still a possibility that

it has been or will be crashed somewhere along its original flight

plan, so that officials can claim having “missed it” during earlier

phases of the massive search. Amidst the tangled wreckage, no one will

be able to tell that the passengers had actually been dead for a week or

two. Another possibility is that the airliner was later transferred to

Pakistan, where its final disposition is anyone’s guess.

Flight 370’s pilots (one of whom being the pro-Islamist Zaharie Ahmad

Shah) may have been afforded the opportunity to continue on to another

Muslim country, blend in and take on a new identity, given the

sentiments of those in the current administration. In any case, it was

the geeks and the goods that the CIA was after, and I’m led to believe

that’s what they got.

My understanding is that the foregoing information has been confirmed

at the highest levels of our government, though not the current one, if

that’s cryptic enough for you.

At least, that’s what my source tells me. And they haven’t been wrong yet.