Most Corrupt Bank In The World ~ Basel III’s HSBC Shutting Down Banking Accounts.

Posted on August 5, 2013

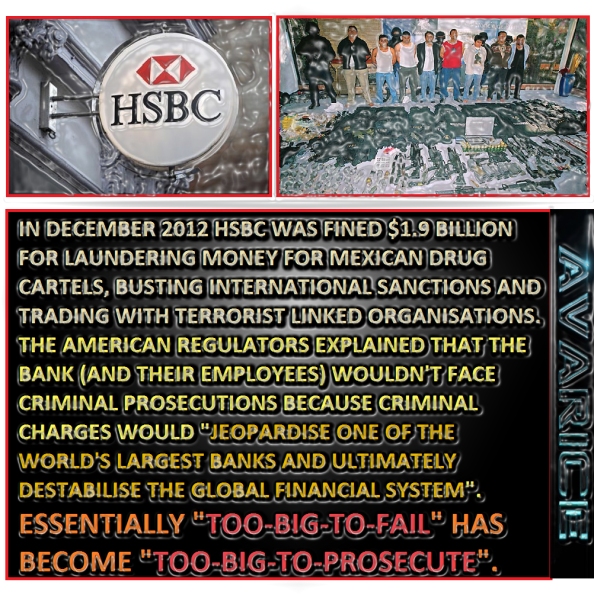

HSBC has recently been charged with money laundering by drug cartels and terrorists all over the world. HSBC was forced to apologize publicly before the US Senate and its compliance chief resigned over facilitating a multi-billion-dollar money-laundering operation for the drug gangs, terrorists and rogue nations worldwide.

- Hungary Orders Rothschild’s IMF To Vacate The Country: Now Issuing Debt-Free Money!

- Barclays, UBS, HSBC, Royal Bank of Scotland Involved in Money Laundering for Corrupt Nigerian Politicians

- Nuclear Physicist Fukushima Fake: A Financial Disaster, But No Nuclear Disaster, Not One Nuclear Death By Human Or Animal.

Obama: 21 US Embassies To Close, Citing Vague ‘Threat’ In Solidarity With HSBC Closing 40 Embassies In Britain

LONDON (AP) — HSBC bank has told dozens of foreign missions in London

that will close their bank accounts, an official said Sunday, news that

has sent diplomats across the capital scrambling to find a new place to

put their money.Bernard Silver, an ex-honorary consul who serves as president of the Consular Corps of London, said he’d been told by British officials that more than 40 different embassies, consulates, and high commissions had been affected.

- Obama’s Kinky Brother Linked To Pedophilia Sex Crime.

- Egyptian Citizens At Work Wiping Out Obama’s Political Muslim Brotherhood ~ Ariel Video: 638 Killed 4,000 Injured, Day of Rothschild Rage Planned by Brotherhood!

- Obama Regime Demands Egypt Release Muslim Brotherhood and Morsi From Prison.

Silver declined to name any specific missions, but the Mail on Sunday newspaper said that the Papal Nunciature — the Vatican’s mission to London — was affected, as was the Papua New Guinea High Commission and the honorary consul from Benin.

Attempts to reach the Vatican’s mission, Benin’s honorary consul, and Papua New Guinea’s high commissioner were not immediately successful, but the newspaper cited an official at the latter as expressing shock at the move.

‘‘We’ve been banking with HSBC for 22 years,’’ John Belavu was quoted as saying. ‘‘For them to throw us off in this way was a bombshell.’’

Below Is The Generic White Wash Media Spiel

HSBC spokesman Will McSheehy said Sunday that the move was taking part of a wider reassessment of its business started by chief executive Stuart Gulliver in 2011. As of May, the bank’s retrenchment strategy has seen 52 peripheral or underperforming units close and a loss of roughly 40,000 staff.McSheehy said the changes had translated into a ‘‘significantly diminished appetite for the embassy business,’’ although he declined to reveal how many U.K. missions had their accounts pulled.

Foreign missions traditionally deal in large amounts of cash, something which may have raised uncomfortable questions at a bank that has been buffeted by money laundering scandals. In 2012 HSBC was slapped with a record fine after U.S. officials revealed that its bankers had been handling assets belonging to Iran, Libya, and Mexico’s murderous drug cartels. HSBC is still struggling to clear its name, including in one case revolving around a former employee who claims to have evidence showing ‘‘scandalous’’ levels of tax evasion and money-laundering at the company.

McSheehy said that compliance issues were just one of many factors — such as profitability or efficiency — which the bank had assessed.

‘‘There’s no one single reason,’’ he said.

Britain’s Foreign Office declined to confirm the number of missions involved, saying only that it had sent an unspecified number of diplomats advice on finding a new U.K. bank. A spokeswoman said there was little more for the British government to do.

‘‘This is a commercial matter,’’ she said, speaking on condition of anonymity in line with office policy.

- Outrageous HSBC Settlement Proves the Drug War is a Joke

- ROLLING STONE : ROTHSCHILD CORRUPTION GOES MAINSTREAM

- RollingStone The Fed’s aka; Rothschild’s Magic Money-Printing Machine: Usurping U.S. Gold Backed Currency!

- Obama’s Secrets And Lies Of The Bailouts: Tarp Ceiling Was Secretly Raised 117 Times ~ RollingStone

- New World Order Chronology: Nothing New Here ~ We Fought This Same Menace In 1776!

- ROLLING STONE: “Conspiracy Theorists Of The World, Believers In The Hidden Hands Of The Rothschilds, We Skeptics Owe You An Apology.”

BASEL III

DODD-FRANK KILLS: BASEL III KILLS:

Here’s a great ole video telling you just how Rothschild was started and its all from a red shield.

HOW U.S. 1776 FREEDOM WAS SEDITIOUSLY ABSCONDED

AND SIGNED OVER TO

THE ROTHSCHILD’S INTERNATIONAL BRITISH BANK OF ENGLAND July 2013

THE TREASONOUS BAIL-IN REGIME OF BASEL III.

Rothschild/Monarchy Machination Began In Earnest Around 1913 To Return The United States Back Under Subservient British Control.

Woodrow Wilson ~ The President who signed the bill allowing Rothschild’s private federal reserve in the United States.

The 28th President’s mother was born in Carlisle, Cumberland, England. Rothschild Banking Cabal England – Woodrow Wilson England – Hmmmmmm!

The 28th President’s mother was born in Carlisle, Cumberland, England. Rothschild Banking Cabal England – Woodrow Wilson England – Hmmmmmm!

WATCH A VIDEO ON THE ACTIONS OF WILSON HERE.

Woodrow Wilson’s London Teeth

In 1913 the Rothschild Federal Reserve Bank was born, with Paul Warburg its first Governor.

Four years later the US entered World War I, after a secret society known as the Black Hand assassinated Archduke Ferdinand and his Hapsburg wife.

The Archduke’s friend Count Czerin later said,

“A year before the war he informed me that the Masons had resolved upon his death.” [5]

That same year, Bolsheviks overthrew the Hohehzollern monarchy in Russia with help from Max Warburg and Jacob Schiff, while the Balfour Declaration leading to the creation of Israel was penned to Zionist Second Lord Rothschild.

- Did Woodrow Wilson REALLY REGRET Handing AMERICA To The Rothschild BANKSTERS?

- Public Regret Announcement: John Boehner Regrets, Woodrow Wilson Regrets! What Sedition Looks Like!

- Roman Catholic Popes Have All Denounced Free Mason’s New World Order: If You Believe Otherwise You’re A Victim Of The Banker’s Propaganda.

Fourth Of July 2013 Treason

Release Date: July 2, 2013

For immediate release:

The Federal Reserve Board on Tuesday approved a final rule to help ensure banks maintain strong capital positions that will enable them to continue lending to creditworthy households and businesses even after unforeseen losses and during severe economic downturns.

George Kennedy’s Memoirs

The corruption of the Congress is as old as the institution itself. What was done and can now be enacted under the new authorities established in Dodd-Frank’s Title II, is of a different class.TREASON

There is little to no recognition of the key fact of Dodd-Frank Act. Namely, Title II of the Act to establish an Orderly Liquidation Authority, vests the FDIC with the authority to conduct a European-style bail-in.

Hearings continue taking place in the House and Senate to review what exactly was voted into law with the 2010 Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) even as the rules for implementing the law are still being written.

SAVE THE BANKS ~ KILL YOURSELF MESSAGE!

- On December 10, 2012, a joint strategy paper was drafted by the [BOE] Bank of England Owned By The Rothschild Mafia and the Federal Deposit Insurance Corporation (FDIC) titled, Resolving Globally Active, Systemically Important, Financial Institutions.7

- The paper compares the resolution regime established by Title II’s Orderly Liquidation Authority (OLA) to the Prudent Regulation Authority (PRA), a similar resolution authority in the United Kingdom.

- The regime in the U.K. was established April 1, 2013 following the dismantling of the Financial Services Authority.

- Beginning in June the PRA will be overseen by Bank of Canada governor and former head of the Financial Stability Board, Mark Carney, when he becomes head of the Rothschild [BOE] Bank of England.8

- After expropriating the material wealth of the United States Of America, the aforementioned international syndicate will have THEIR financial stability after years of bilking wealth through murder, sabotage, swindling, blackmail, etc etc.

The final rule minimizes burden on smaller, less complex financial institutions.; It establishes an integrated regulatory capital framework that addresses shortcomings in capital requirements, particularly for larger, internationally active banking organizations, that became apparent during the recent financial crisis.

The rule will implement in the United States the Basel III regulatory capital reforms from the Basel Committee on Banking Supervision and certain changes required by the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Read More Here

Save The United States From Sedition / Treason ~ Shut Down Rothschild Mafia By Enacting The Glass Steagall Act And Enforcing The Anti Trust Laws Against Rothschild And Other Corporations That Are Merging Into A One Fascist Statism.

- Read the full text of the Glass-Steagall Act (a.k.a. the Banking Act of 1933)

- 1999 REPEAL OF GLASS-STEAGALL: Bill Clinton Opened The Door For Creating $Trillions Of Derivative Debt & Bailout

- Jeff Steinberg On Bill Clinton’s Repeal of Glass-Steagall In 1999: This Was Rothschild’s Mechanism To Overload America With Debt Subservience!

Leandra Bernstein

2013

From Bail Out To Bail In ~ Rothschild Plays Both Sides Always => This Is Controlled by murder/bribery etc. vs Law Abiding Supply Demand.

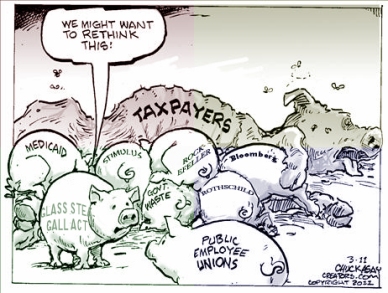

The preamble to the Dodd-Frank Act claims “to protect the American taxpayer by ending bailouts.” This is done, however,  through bail-in,

through bail-in, Bail-in,

As is stated in an IMF review of the policy from April 2012,

“The statutory bail-in power is intended to achieve a prompt recapitalization and restructuring of the distressed institution.”

In the case of resolving a distressed globally active, systemically important, financial institution (GSIFI), bank creditors, specifically those whose assets exceed the FDIC insurance cap, will be subject to expropriation.

- This is not normal bankruptcy.

- Accounts and assets are seized and/or converted to stock under the resolution authority.

- The institution is prevented from failing.

- Values of securities are not written down through sale on the open market.

- And this is done to guarantee the continued operation of the financial institution and the “stability” of the financial system.

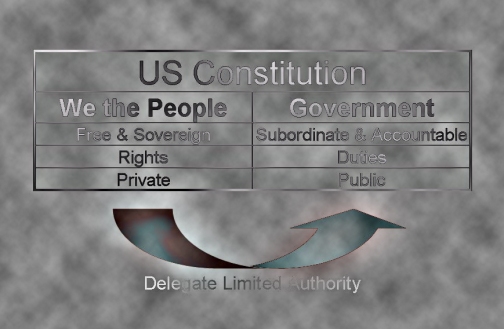

This report provides the evidence, primarily using the text of laws, charters, and the language of the administrators of the bail-in regime, to demonstrate that the United States of America is being subject to the premeditated scheme of an international syndicate to establish laws and treaties contrary both to the interests of the United States, and the spirit and the law of the U.S. Constitution.

- The Dodd-Frank Act, as currently written, has no evident provision that would prevent the overall effect of mass economic deprivation of the targeted subjects, the American citizenry.

- Such deprivation across the spectrum of economic activity would invariably lead to a sharp increase in the nation’s death rate, as a direct consequence of the enactment of this law.

If this Act is not nullified, the result of its enactment will be the mass destruction of U.S. citizens through economic means.

If this Act is not nullified, the result of its enactment will be the mass destruction of U.S. citizens through economic means.

- The fact that this has not been stated openly, other than in the following report, does not improve the arguments of those who fail to annul this law.

Nullification By 10th. Amendment

As a result of any among a vast variety of financial crises waiting to happen, the 2010 Dodd-Frank Act must be nullified immediately by its repeal and the simultaneous passage of the Glass-Steagall Act as drafted in Senate Bill 985 and and House of Representatives Bill 129.

RESOLUTION:

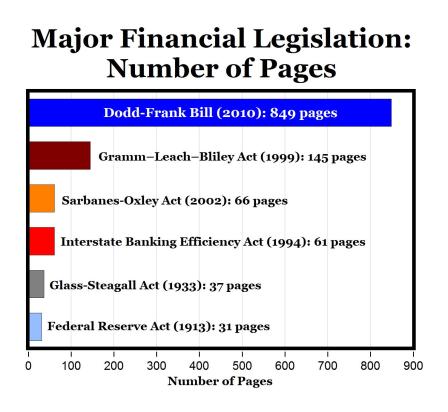

- As passed, Dodd-Frank took up 848 pages and contained 383,013 words.

- According to the financial law firm Davis Polk, as of July 2012 an additional 8,843 pages of rules were added, representing only 30% of the rules to-be-written.

- The estimate for the final length of the Act is 30,000 pages.2

- Additionally, the six largest banks in the U.S. spent $29.4 million lobbying Congress in 2010, and flooded Capitol Hill with about 3,000 lobbyists–a ratio of 5 lobbyists per 1 congressman.3

Hearings continue taking place in

the House and Senate to review what exactly was voted into law with the

2010 Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act)

even as the rules for implementing the law are still being written.

the rules for implementing the law are still being written.

the rules for implementing the law are still being written.

the rules for implementing the law are still being written.- The Dodd-Frank Wall Street Reform and Consumer Protection Act currently stands as the single longest bill ever passed by the U.S. government.4

- It has been argued that the length of the bill itself was intended to intimidate members of Congress.

- There has been public commentary suggesting that few congressmen even read the bill, but were cowed into voting for it strictly on the basis of party loyalty under a first-term President Barack Obama who kept his party in line using whatever means were at his disposal.5

- In the first House vote, not a single Republican voted for the bill.

- In the final House vote of 237-192, three Republicans joined the ayes and only 19 Democrats voted against the bill.

- In the final Senate vote, 55 Democrats were joined by 3 Republicans and both Independents to pass the bill which was then signed into law by President Obama on July 21, 2010.

- More of the implications of Dodd-Frank have been revealed,

but only after its passage.

but only after its passage. - There has been an inadequate response from members of the U.S. government who presumably voted for the Act, or failed to defeat it.

- Even after witnessing the fallout from the resurgent European crisis, little has been done.

- Moreover, for freshman members of Congress, there is a new wave of

financial interests descending on Capitol Hill to scope out the best

candidates for campaign contributions, as veteran members

submit and pass bills literally written by financial institutions.6

submit and pass bills literally written by financial institutions.6

- 10 Banking Maneuvers To Watch For In 2013!

- The Putrid Smell Suddenly Emanating From LIBOR Rigged European Banks: Lies, Damned Lies, Deutsche Bank Caught Again!

- Final Countdown Of The Banker’s Usurpation Fallout: Enslavement Of You For Them To Escape Justice ~ Using Your Tax Money To Do It!

- The Big Dogs On Wall Street Are Starting To Get Very Nervous: Coming To America? China & Iran to Execute Bankers On Fraud Charges!

The financial crisis that began in 2007 has driven home the importance of an orderly resolution process for globally active, systemically important, financial institutions (G-SIFIs)… These strategies have been designed to enable large and complex cross-border firms to be resolved without threatening financial stability and without putting public funds at risk…

- In the U.S., the strategy has been developed in the context of the powers provided by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

- Such a strategy would apply a single receivership at the top-tier holding company, assign losses to shareholders and unsecured creditors of the holding company, and transfer sound operating subsidiaries to a new solvent entity or entities.9

- Prior to resolution, a financial entity is entitled to petition the U.S. District Court of the District of Columbia if it is believed that the decision to resolve is erroneous or capricious.

- But at the court level, such a decision is made, “On a strictly confidential basis, and without any prior public disclosure…”

- States Enforcing The United States Constitution: Florida Moves To Nullify Obamacare & Supreme Court Justice Roberts!

- DeFazio Impeachment Probe of Chief Justice Roberts: Unlimited Corporate Spending In Elections As “Person” Is Unconstitutional.

- Defending Marriage In An Age Of Unreason: Theology Professor Gives Natural Law Argument Against Homosexual ‘Marriage’

- Did Justice (sic) Roberts Sell His Soul To The Devil: The 16th. Amendment Constitutionally Prohibits The IRS Taxing Personal Income Because One Does Not Purchase A Government Insurance & Is Therefore Legally Avoidable!

- This means there is to be no disclosure to unsecured creditors, or other affected parties.

- Under the law, premature or “reckless” disclosure can result in fines up to $250,000, imprisonment for up to 5 years, or both. (Title II, Sec. 202, 1, A.)

- Moreover, if a creditor objects to resolution, they have a limited amount of time to petition for redress.

- For example, if a state government with its state workers’ pensions

invested in the distressed institution, objects to the terms or the

triggering of resolution and wishes to exempt its funds from ,

bailing-in the institution, they have 24 hours to petition the courts.

bailing-in the institution, they have 24 hours to petition the courts.

Rothschild

Czar & Card Tricks For Corporatism Control Of The United States Of

America In Flagrant Violation Of The United States Constitution.

In June 2012 an official lawsuit

was filed in the U.S. District Court of the District of Columbia

challenging the constitutionality of the Dodd-Frank Act on a number of

counts, including the failure to allow for due process of law.10

LAWSUIT => Unchecked

Power of Rothschild Using Innocuous Frank-Dodd Scheme To Centralize

America’s Finances To [BOE] Bank Of England Unconstitutional.

The original suit was filed by the State

National Bank of Big Spring, Texas; the 60 Plus Association; and the

Competitive Enterprise Institute.

This suit has been joined by the attorneys general of 11 states:

- Michigan

- Alabama

- Georgia

- Nebraska

- Kansas

- South Carolina

- Oklahoma

- West Virginia

- Texas

- Montana

- Ohio

Rothschild’s Handbook For Banker’s World Control: Elders Of Zion

From the Introduction, Legislative frameworks for implementing the strategy:- Title I of the Dodd-Frank Act requires each G-SIFI to periodically submit to the FDIC and the Federal Reserve a resolution plan that must address the company’s plans for its rapid and orderly resolution under the U.S. Bankruptcy Code.11 …

- Title II of the Dodd-Frank Act provides the FDIC with new powers to resolve SIFIs by establishing the orderly liquidation authority (OLA).

- Under the OLA, the FDIC may be appointed receiver for any U.S. financial company that meets specified criteria, including being in default or in danger of default, and whose resolution under the U.S. Bankruptcy Code (or other relevant insolvency process) would likely create systemic instability.12

- Title II requires that the losses of any financial company placed into receivership will not be borne by taxpayers, but by common and preferred stockholders, debt holders, and other unsecured creditors, and that management responsible for the condition of the financial company will be replaced.

- Gov. Mitch Daniels: U.S. Debt Is Accumulating At A Terrifying Rate: Obama Prints $110 Billion Each MonthFor U.S. Taxpayers To Pay back!

- Once appointed receiver for a failed financial company, the FDIC would be required to carry out a resolution of the company in a manner that mitigates risk to financial stability and minimizes moral hazard.

- Any costs borne by the U.S. authorities in resolving the institution not paid from proceeds of the resolution will be recovered from the industry.

PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER,

Obama’s Web Of Debt: Its The PAPER Derivatives Stupid.

- The above statement assumes that the costs of resolution will be covered by those creditors slated to bear the losses as well as an Orderly Liquidation Fund to bear the administrative costs of resolution.

- What is further proposed for those creditors whose claims are not liquidated, is their conversion to shareholders, the debt becomes stock acting to prop up the value of the resolved institution.

- What would otherwise occur in bankruptcy, meting out claims to creditors based on priority, does not happen.

A crucial clarification of what constitutes a bank creditor was made in a March 28, 2013 review of the BOE-FDIC paper by chairwoman of the Public Banking Institute, Ellen Brown. Ellen 1 Ellen 2

Rather, the liquidation of the firm does not occur, it is kept operational, and is in that way bailed-in by its creditors.

In the course of explaining why the

bail-in, confiscation of 40% of unsecured deposits in Cyprus was not a one-time event, she clarifies:

bail-in, confiscation of 40% of unsecured deposits in Cyprus was not a one-time event, she clarifies:- Although few depositors realize it, legally the banks owns the depositor’s funds as soon as they are put in the bank.

- Our money becomes the bank’s, and we become unsecured creditors holding IOUs or promises to pay. …

- Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” …

- With any luck we may be able to sell the stock to someone else, but when and at what price?13

As with the triggering of OLA, this can be done quite literally overnight.

To retrieve the value of what was formerly assumed to be the depositor’s account balance, the stock must be sold.

For example, a former depositor with an account balance of $250,000,

who now owns that amount in bank stock, owns that amount of stock in a

bank that just underwent a major, cross-border, government restructuring

because it was in imminent distress.The receiver, the FDIC, determines which values in the bank must be upheld in the interest of “financial stability,” and this undoubtedly includes financial derivatives, and other debt instruments, which, if sold off in the course of orderly liquidation would cause a panic.

The obvious question is, how much will the depositor be able to sell his stock for?

UNSECURED CREDITORS:

According to the April 24, 2012 IMF report,14 conversion of bank debt to stock is an essential element of bail-in included in Dodd-Frank.

conversion of bank debt to stock is an essential element of bail-in included in Dodd-Frank.“The contribution of new capital will come from debt conversion and/or issuance of new equity, with an elimination or significant dilution of the pre-bail in shareholders. …Some measures might be necessary to reduce the risk of a ‘death spiral’ in share prices.”In the language of Dodd-Frank, this will:

“ensure that unsecured creditors bear losses.”

- Such a conversion of deposits into equity already had its test-run under the terms of bankruptcy reorganization of Bankia and four other Spanish banks earlier this year.

- The conditions of a July 2012 Memorandum of Understanding between the Troika (EC, ECB, and IMF) and Spain, resulted in over 1 million small depositors becoming stockholders in Bankia when they were sold “preferentes” (preferred stock) in exchange for their deposits.

- Following the conversion, the preferentes took an initial write-down of 30-70%.

- Soon after, they were converted into common stock originally valued at EU2 per share, which was further devalued to EU0.1 after the March restructuring of Bankia.15

Following the triggering of Dodd-Frank’s Title II authorities, and the FDIC taking receivership at the top tier parent holding company of a GSIFI, assets will be transferred to recapitalize the parent company, in its original and other incarnations, and written down.To capitalize the new operations–one or more new private entities–the FDIC expects that it will have to look to subordinated debt or even senior unsecured debt claims as the immediate source of capital. The original debt holders can thus expect that their claims will be written down to reflect any losses in the receivership of the parent that the shareholders cannot cover…

PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER,

Obama’s Web Of Debt: Its The PAPER Derivatives Stupid.

- What Iceland Teaches Us: “Let Banks Fail”

- Last Lap Dance For Rothschild: Iceland’s Viking Victory Over The Matrix Banksters!

- Its Time To Get ICELANDIC On Rothschild: Interpol Arrest Warrant For Einarsson Sigurdur!

- Iceland Dismantles The Corrupt, Arrests 10 Rothschild Bankers, Then Issues Interpol Arrest Warrant For Rothschild Banker Sigurdur Einarsson!

- This is not simply a hair-cut to bond holders, creditors, and others, but a guarantee that those who are invested in the institution, with money in the depository branch of the institution (understood as depositors), will be made responsible for the continued operation of the institution.

- Depositors as well as creditors become financially responsible for keeping the institution open and operating, instead of being allowed to go bankrupt, as would be the case for a non-GSIFI.

- The depository and investment branches are, in this way, called upon equally to bail-in.

- Under the existing legislation, the FDIC has the power to impose losses on unsecured creditors in the process of resolving failing banks.

- For example, the FDIC resolved Washington Mutual under the least-cost resolution method in 2008 and imposed serious losses on the unsecured creditors and uninsured depositors (deposit amount above USD 100,000).

- The Orderly Liquidation Authority (OLA) established under the Dodd-Frank Act further expands the resolution authority of FDIC.

- Subject to certain conditions, the FDIC now also has the powers to cherry-pick which assets and liabilities to transfer to a third party and treating similarly situated creditors differently, eg: favoring short-term creditors over long-term creditors or favoring operating creditors over lenders or bondholders.16

INTERNATIONAL FRAMEWORK IN PLACE:

They key issue taken up by Dodd-Frank in its drafting and passage was cross-border

cross-border  resolution

of the so-called global systemically important financial institutions

also called GSIBs, or global systemically important banks in other

locations.

resolution

of the so-called global systemically important financial institutions

also called GSIBs, or global systemically important banks in other

locations.- Capps Law: Ticking Time Bomb Inside Obamacare.

- Bankers With Out Boundaries [NWO] ~ Obama’s French Felon Nadhmi Auchi & French Felon George Soros!

- This obviously necessitates cooperation with other nations.

- Provisions of Dodd-Frank

explicitly

authorize this coordination with foreign authorities to take action to

resolve those institutions whose collapse threatens financial stability.

explicitly

authorize this coordination with foreign authorities to take action to

resolve those institutions whose collapse threatens financial stability. - As is stated in Title II, Sec. 210, N, the FDIC, acting as the

receiver for such a financial institution in distress, “shall

coordinate, to the maximum extent possible, with the appropriate

foreign

financial authorities regarding the orderly liquidation of any covered

financial company that has assets or operations in a country other than

the United States.”

foreign

financial authorities regarding the orderly liquidation of any covered

financial company that has assets or operations in a country other than

the United States.” - RollingStone The Fed’s aka; Rothschild’s Magic Money-Printing Machine: Usurping U.S. Gold Backed Currency!

- Chairman of the FDIC, Martin Gruenberg, elaborated on the

cross-border strategies codified under Dodd-Frank in a June 9, 2012 speech in Chicago.

cross-border strategies codified under Dodd-Frank in a June 9, 2012 speech in Chicago. - He stated that since the passage of Dodd-Frank, the FDIC has taken

action to carry out its new resolution authorities, including

increasingly coordinating cross-border resolution with foreign

regulators, in particular the

United Kingdom, where “the operations of U.S. SIFIs are concentrated.”

United Kingdom, where “the operations of U.S. SIFIs are concentrated.”

- As I mentioned earlier, the type of firm we would need to resolve will likely have significant international operations.

- This creates a number of challenges…

- The FDIC has participated in the work of the Financial Stability Board through its membership on the Resolution Steering Group, which produced the Key Attributes of Effective Resolution Regimes for Financial Institutions.

- We have also participated in the Cross-border Crisis Management Group and a number of technical working groups, and

have co-chaired the Basel Committee’s Cross-border Bank Resolution Group since its inception in 2007. …

have co-chaired the Basel Committee’s Cross-border Bank Resolution Group since its inception in 2007. …

- Ready? Basel III 2013 – 2019: The Dump Phase Of The Cartel’s Pyramid Scheme Begins!

- Criminal Elements In The White House, Caught Altering Stimulus Baseline Projection By 7 Million Jobs

- U.S. Must PreEmptively Declare Bankruptcy Against Mr. Pick & Choose Rothschild Or Roll Back The Fake Debt: Rothschild IS The Receiver If The United States Corporation Declares Bankruptcy!

- Americans Fighting Back Against GMO Eco-Terrorism: Basel III GMO Poisoned Beets In Oregon Destroyed!

These

5 crooks are the ones most responsible for the financial corruption

presently in motion. These 5 crooks undermined The Glass Steagall Act

which protected Americans from Bank exploitation thru derivative fraud.

Later in 1999 they got Bill Clinton to sign the repeal of The Glass

Steagall Act.

The Elites Responsible For Orchestrating The Destruction Of The Glass Steagall Act Of 1933:

- Goldman Sachs:

- Alan Greenspan

- Rothschild Federal Reserve:

- Alan Greenspan

- Larry Summers

- Citibank:

- Sandy Weill

- John Reed

- Robert Rubin

- Traveller’s Insurance:

This sea change in regulation was orchestrated by Sanford Weill and assisted by Robert Rubin, who became the second in command at Citibank after his stint at The U.S.Treasury.

Rubin, was Clinton’s Secretary of Treasury and was instrumental in getting The Gramm-Leach-Bliley Act passed. Larry Summers, was then his current Secretary Of Treasury who is now one of Obama’s economic “advisors”. What goes around comes around, they are all culpable.

“Commercial banks are not supposed to be high-risk ventures; they are supposed to manage other people’s money very conservatively,” writes Nobel Prize-winning economist Joseph Stiglitz. “It is with this understanding that the government agrees to pick up the tab should they fail. Investment banks, on the other hand, have traditionally managed rich people’s money — people who can take bigger risks in order to get bigger returns. When repeal of Glass-Steagall brought investment and commercial banks together, the investment-bank culture came out on top.The Stooges That Wrote The Gramm-Leach-Bliley ‘Bill’ aka; Financial Services Modernization Act that is presently destroying the World.

Common Dreams

Wall Street Bankers & Insurance Companies Got Stooges To Write A Bill To Repeal The Glass Steagall And Thus Loot The U.S. Citizens Depository Earnings Into Speculative High Risk Investments Were:

- Congressmen Phil Gramm (R-Texas)

- Jim Leach (R-Iowa)

- Thomas J. Bliley, Jr. (R-Virginia)

No need to study the Senate Or House Records to see if it was Democrat Or Republican as Gramm-Leach-Bliley passed with bi-partisan support. Those who clandestinely supported the bankers, and knew the *bill* would pass like Charles Schumer, would vote against the *bill* to maintain a “for the people image” for re-election.

- Deadbeat New York Senator Charles Schumer: Covers For Deadbeat New York Mayor Bloomberg’s Expatriated Millions To Oversea Banks!

- Charlie Schumer’s Shuffle: The Benedict Arnold Of The Glass Steagall Act & The Rothschild Champion Sleeper Cell For Wall Street!

- The International Banking Cabal Must Be Disgorged ~ Libor Scandal

- RollingStone The Fed’s aka; Rothschild’s Magic Money-Printing Machine: Usurping U.S. Gold Backed Currency!

- Convicted Felon George Soros: Crafted The So Called Stimulus Plan & Invested in Companies That Would Profit From It. Calling Darrell Issa

- We conducted a heat-map exercise that determined that the operations

of U.S. SIFIs are concentrated in a relatively small number of

jurisdictions, particularly the

United Kingdom (U.K.).

United Kingdom (U.K.). - Working with the authorities in the U.K., we have made substantial progress in understanding how possible U.S. resolution structures might be treated under existing U.K. legal and policy frameworks.

- We’ve examined potential impediments to efficient resolutions in depth, and are on a cooperative basis in the process exploring methods of resolving them.17

- It is accurate to say that the

first

incarnation of a serious cross-border resolution regime was established

at the April 2009 G20 summit in London, the first summit attended by

the newly elected President Barack Obama.

first

incarnation of a serious cross-border resolution regime was established

at the April 2009 G20 summit in London, the first summit attended by

the newly elected President Barack Obama. - At that time, the Financial Stability Board (FSB) emerged as an entity “with a broadened mandate to promote financial stability.”

- The board currently consists of all G20 member nations’ central financial institutions, a handful of other nations, international organizations, and international financial standard-setting bodies.18

- In October of 2011, the Financial Stability Board published a document reflecting the agreement among the participating bodies of the FSB to conduct cross-border resolutions of financial institutions.

That document features extensive discussion of the establishment of  cross-border resolution authorities within the law of each participating nation.

cross-border resolution authorities within the law of each participating nation.

cross-border resolution authorities within the law of each participating nation.

cross-border resolution authorities within the law of each participating nation.

Building The Rothschild Matrix

- Nullification By 10th. Amendment

- Montana, Arizona And Tennessee Take the Lead on Broad-Based Nullification Of Federal Power!

- South Carolina Affirms U.S. Constitution ~ Declares Obamacare A Crime: Nullifies Supreme Court’s Decision To Violate Constitution’s Tax Clause!

- In order to facilitate the coordinated resolution of firms active in multiple countries, jurisdictions

should

seek convergence of their resolution regimes through the legislative

changes needed to incorporate the tools and powers set out in these Key

Attributes

should

seek convergence of their resolution regimes through the legislative

changes needed to incorporate the tools and powers set out in these Key

Attributes  into their national regimes.

into their national regimes. - The report goes on to enumerate the requirements of a domestic, legal and active authority to resolve “any financial institution that could be systemically significant if it fails.”

- Given the similarity of the language of Dodd-Frank and the FSB report, it would be a worthwhile venture to analyze whether it is the case that all of the requirements in the FSB report are also contained explicitly in the 2010 U.S. legislation.

- What is most significant in the FSB Key Attributes is the

strict emphasis on coordinating the bail-in regimes above and beyond national borders.

strict emphasis on coordinating the bail-in regimes above and beyond national borders. - The report reflects a sincere dedication

to establish active authorities in each jurisdiction where a parent holding company or its subsidiaries are located.

to establish active authorities in each jurisdiction where a parent holding company or its subsidiaries are located.

7.1 The statutory mandate of a resolution authority should empower and strongly encourage the authority wherever possible to act to achieve a cooperative solution with

foreign resolution authorities.

foreign resolution authorities.7.2 Legislation and regulations in jurisdictions should not contain provisions that trigger automatic action in that jurisdiction as a result of official intervention or the initiation of resolution or insolvency proceedings in another jurisdiction, while reserving the right of discretionary national action if necessary to achieve domestic stability in the

absence of effective international cooperation and information sharing.

absence of effective international cooperation and information sharing.Where a resolution authority takes discretionary national action it should consider the impact on financial stability in

other jurisdictions.

other jurisdictions.

Christopher

Dodd & Barney Frank’s bill BLOCKED The Glass Steagall Act that

would protect American retirement & banking accounts.

Where

a resolution authority acting as host authority takes discretionary

national action, it should give prior notification and consult the

foreign home authority.

Where

a resolution authority acting as host authority takes discretionary

national action, it should give prior notification and consult the

foreign home authority.- Remembering Chris Dodd?

- The ‘Man of Steel’ Is Just More Propaganda From A Protected Racket: By Ex Senator Christopher Dodd ~ Current Chairman Of The Motion Picture Association Of America!

- Dodd (d-conn) Hides Out In Ireland On A Real Estate Bonanza, That He Does Not Know How Much He Paid For!

- Bill Clinton, Christopher Dodd, Newt Gingrich, & The Member List Of The Unsanctioned CFR “The Hidden Seditious Banker’s Club.”

bail-in, to be enacted within a host nation of that bank.

bail-in, to be enacted within a host nation of that bank.In the case of the United States, for example, if resolution were to be triggered by a large British bank, such as HSBC, Barclays, or a European bank, such as Deutsche Bank, UBS, etc., the United States

would be obligated, based on the FSB agreements, to take part in resolution.19

would be obligated, based on the FSB agreements, to take part in resolution.19

Under the provisions of Dodd-Frank, the resolution authorities are already established in law, in fact.

Such a coordinated regime was agreed to by the Heads of State and Government of the Group of Twenty in establishing the Charter of the Financial Stability Board in April 2009, reflecting the interests of that body:“to coordinate at theinternational level the work of national financial authorities and international standard setting bodies (SSBs) in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies.”20

FIRST IN LINE:

- There have been numerous documents written comparing Dodd-Frank’s

orderly liquidation authority to regular bankruptcy under U.S. law. What

is most notable in the comparisons is

who gets priority during resolution, and on what basis that is determined.

who gets priority during resolution, and on what basis that is determined. - The Cornell University Legal Information Institute, writes that Title II is aimed at “ensuring that payout to claimants is at least as much as the claimants would have received under bankruptcy liquidation.”

- Impartial as it may seem, the problem that arises from that statement is

that

liquidation during resolution is done at the discretion of the

receiver, the FDIC, on the basis of salvaging what is, in its view,

that

liquidation during resolution is done at the discretion of the

receiver, the FDIC, on the basis of salvaging what is, in its view,  most important for financial stability.

most important for financial stability.

“shall, to the greatest extent practicable, conduct its operations in a manner that –

…(iii) mitigates the potential for serious adverse effects —-

—to the financial system.”

The current financial system, GSIFIs most emphatically, are highly leveraged, hugely undercapitalized, and rely on classes of assets in the form of securities contracts, collateralized debt obligations, derivatives, and other debt instruments, to maintain the appearance of solvency.

PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER, PAPER,Uncertainty in the value of a category of such assets triggered by any outstanding event, for example, the announcement of bank resolution, would create an across-the-board devaluation among all holders of those assets, thereby guaranteeing “adverse effects to the financial system.”

Obama’s Web Of Debt: Its The PAPER Derivatives Stupid.

Creating these effects would constitute “disorderly liquidation.” Preventing these effects constitutes “orderly liquidation.”

As stated in the IMF report, From Bailout to Bail-In, disorderly liquidation can create risks to overall financial stability:

i. through direct counterparty risks when the failing institution fails to meet its financial obligations

ii. through liquidity risks and fire-sale effects in asset markets, when the distressed institution is forced into asset sales to obtain liquidity which further depresses asset prices (and thus raises demand for higher “margin”)

iii. through contagion risks when the panic caused by the failure of one institution spreads to other financial institutions.21

IOWs, They want Rothschild Banking To Control All Wealth Going Up Or Down Without Any Risk As They Now Portray The World As Theirs To Define.

Again, if these three risks are to be avoided effectively, the assets of the institution, regardless of their legitimacy or actual market value, would have to be bailed-in.

bailed-in.Their values would have to be preserved, presumably within the bridge financial company, to ensure that similar assets held by other institutions do not suffer the “contagion effect” seen in the Lehman Brothers crash of 2008 and its aftermath.

Moreover, under the Bankruptcy Reform laws of 2005, securitized derivatives counterparties are

given priority status in the event of bankruptcy.22

given priority status in the event of bankruptcy.22 Winner Takes All: The Super-priority Status of Derivatives

Winner Takes All: The Super-priority Status of Derivatives

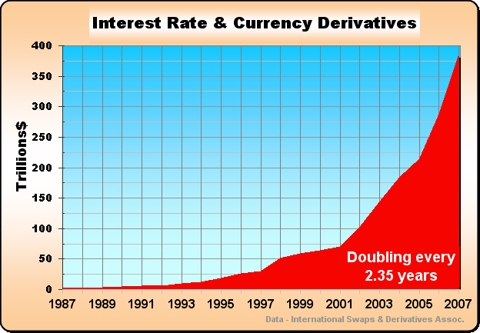

- This is highly consequential for GSIFIs, as it is the case that the majority of the world’s derivatives are concentrated in those institutions.

- By popularly quoted estimates, as of 2010

the total world derivatives had a notional value of $1.2 quadrillion, approximately 20 times the world GDP.

the total world derivatives had a notional value of $1.2 quadrillion, approximately 20 times the world GDP. - Because of the opacity of the derivatives market, the exact numbers are virtually impossible to produce.

- However, the Bank for International Settlements quoted global OTC derivatives–derivatives that have a paper-trail–at $632 trillion as of December 2012.23

- If it is the case, as indicated by the Legal Information Institute

that payouts to claimants would be equivalent to what they would receive

under liquidation in bankruptcy, despite the priority of payments listed in Dodd-Frank,24 –>

securitized derivatives

counterparties would be first to recoup their money followed by those

asset holders whose claims, if exposed to be valueless, would create a

disorderly, chain-reaction collapse.

securitized derivatives

counterparties would be first to recoup their money followed by those

asset holders whose claims, if exposed to be valueless, would create a

disorderly, chain-reaction collapse.

Independence From British Puritans

REASSERTING U.S. LAW:

The case has been made and put on the record using facts that virtually every member of government did not find pressing or compelling enough to take into consideration in the course of making national law. What has been presented is now available to American lawmakers and members of governments internationally.

This report itself, in the days

following its publication, is being distributed to the same, and is

widely available to the public at large.

The point that has been made implicitly throughout this documentation must be made explicit at this time.The consequences of enforcing the provisions of Dodd-Frank, or the agreements under the Charter of the Financial Stability Board as discussed above, amount to a violation of the spirit and the law of the United States of America.

The preceding provisions of law and international agreements have been made in such a way that places the interests of “financial stability” above the interests of the people of the United States and their Government.

Banking Cabal’s Federal Government: Sues Last Great American Company Apple Macintosh For Antitrust ~ While NWO Banking Cabal Conglomerates/Merges Weather, Banks, Gold, & Land.

The very definition of what is meant by financial stability has been codified by those whose present and future positions of power and authority depend upon that definition.Moreover, what is established through this legislation will result in the mass destruction of the citizens of the United States through economic deprivation, through the collection and extraction of funds done in such a way as to leave the targeted subjects of the law desperate to the point of extermination.

Within the texts cited above, there appears to be no evidence suggesting the contrary to be true.

- Weather Mafia: Violation Of Antitrust Laws

- NWO Rothschild Purchases Weather Central: Why? To Control The Warming Hype What Else?

- Rothschild’s Corporate Fascist Empire: Food Crisis, Land Grabs, Poverty, Slums, Environmental Devastation And The Resistance To The People’s Justice!

What underlies the founding laws of the nation is the issue of Right.

The right of the nation to govern itself and to govern in a way that upholds the right of each citizen to his or her life, that most fundamental value in law.

Bill

Of Rights Are Unalienable Rights they are NOT Inalienable Rights.

Inalienable Rights are a legal ease trapping in the court system. Know

Your Rights!!! http://politicalvelcraft.org/2013/04/19/kansas-governor-signs-bill-nullifying-obamas-violation-of-the-bill-of-rights-federal-attempt-to-gun-control/

- The New World Order is “Communism”: Also Known As Rothschildism Or More Bluntly Robbery!

- America Calls For Print Control: To Save Our Country ~ Enforce Print Control On Rothschild Federal Reserve!!

However, after expropriating the material wealth of the nation, the aforementioned international syndicate will have financial stability.

Footnotes

3Robert Reich, “The Shameful Murder of Dodd-Frank”: July 20, 2011.

5Recent

White House-linked scandals including AP and other news agency

wiretapping, IRS targeting of conservative groups, and ongoing questions

of the legality of domestic and foreign extrajudicial assassinations,

raise questions regarding what tactics Obama has used to influence both

his political enemies and allies.

6“Banks’ Lobbyists Help in Drafting Financial Bills,” Eric Lipton & Ben Protus. New York Times Dealbook, May 23, 2013.

7Resolving Globally Active, Systemically Important, Financial Institutions, a joint paper by the Federal Deposit Insurance Corporation and the Bank of England. December 10, 2012.

8Former

BOE Monetary Policy Committee member Charles Goodhart noted of the

transition from the quasi-independent FSA to the PRA, “It’s arguable the

scope of the powers, the range of powers, is now greater than any other

central bank.” Scott Hamilton and Jennifer Ryan, “BOE Power Shift Takes

Hold As Regulation Role Crystallizes.” Bloomberg News: April 2, 2013.

9This

entity is likely the bridge financial company. “The term ‘bridge

financial company’ means a new financial company organized by the

Corporation in accordance with section 210(h) for the purpose of

resolving a covered financial company.” (Dodd-Frank, Title II, Sec. 201;

3.)

10The

original suit was filed by the State National Bank of Big Spring,

Texas; the 60 Plus Association; and the Competitive Enterprise

Institute. This suit has been joined by the attorneys general of 11

states: Michigan, Alabama, Georgia, Nebraska, Kansas, South Carolina,

Oklahoma, West Virginia, Texas, Montana, and Ohio. See:cei.org/doddfrank

11The so-called “Living Will.”

12Title II, Sec. 203, a.

13Ellen

Brown, “It Can Happen Here: The Confiscation Scheme Planned for US and

UK Depositors.” webofdebt.wordpress.com: March 28, 2013.

14Jianping Zhou, Virginia Rutledge, et al. op. cit.

15See LPAC-TV broadcast with EIR Ibero-America Editor, Dennis Small, March 27, 2013.“Cyprus Template: The Case of Spain.”

17Martin

J. Gruenberg, Chairman, Federal Deposit Insurance Corporation. Speech

to Federal Reserve Bank of Chicago Bank Structure Conference, June 9,

2012.

18As

of April 4, 2013 membership in the FSB included the following

jurisdictions: Argentina, Australia, Brazil, Canada, China, France,

Germany, Hong Kong, India, Indonesia, Italy, Japan, Mexico, The

Netherlands, Republic of Korea, Russia, Saudi Arabia, Singapore, South

Africa, Spain, Switzerland, Turkey, United Kingdom, United States of

America. International organizations: Bank for International

Settlements, European Central Bank, European Commission, International

Monetary Fund, Organization for Economic Cooperation and Development,

The World Bank. (Full list at financialstabilityboard.org)

- China Braces For Long-Anticipated Collapse!

- China’s Debt ‘Out Of Control’: May Surpass Financial Crisis In The US Housing Market Crash ~ China’s Ghost Cities!

- The Big Dogs On Wall Street Are Starting To Get Very Nervous: Coming To America? China & Iran to Execute Bankers On Fraud Charges!

- China Set To Lose Out To Vietnam As Obama’s Deadly Non-Transparent TPP Deal Looms: TPP Isn’t Really A Trade Agreement ~ It’s A Rothschild International Corporate Coup!!

- Obama’s Eric Holder Orders Indictments Halted In U.S. Espionage Case: China Access To Protected U.S. Space Weapons Technology ~ China Developing Drone Fleet Against U.S – Report.

- Breaking => The Answer To China’s Ghost Cities: Destroying Farm Production [Agenda 21] By Forcing The Rural Chinese Into Newly Built $Consumer Based Urban Concentration Cities. THEN DEPOPULATION!

19As

of November 2012 the FSB published a list of GSIFIs for whom

cross-border resolution would apply. The list of 28 institutions

includes: Citigroup, Deutsche Bank, HSBC, JP Morgan Chase, Barclays, BNP

Paribas, Bank of America, Bank of New York Mellon, Credit Suisse,

Goldman Sachs, Mitsubishi UFJ FG, Morgan Stanley, Royal Bank of

Scotland, UBS, Bank of China, BBVA, Groupe BPCE, Group Crédit Agricole,

ING Bank, Mizuho FG, Nordea, Santander, Société Générale, Standard

Chartered, State Street, Sumitomo Mitsui FG, Unicredit Group, Wells

Fargo.

20Charter of the Financial Stability Board, September 25, 2009. Amended by the G20 Heads of State and Government June 19, 2012.

21Jianping Zhou, Virginia Rutledge, et al. op. cit.

22More documentation will become available on larouchepac.com and larouchepub.comon the priority status given to derivatives in resolution and bankruptcy.

Also see Ellen Brown, “Winner Takes All: The Super-priority Status of Derivatives.” webofdebt.wordpress.com: April 9, 2013.

Also see Ellen Brown, “Winner Takes All: The Super-priority Status of Derivatives.” webofdebt.wordpress.com: April 9, 2013.

23BIS Quarterly Review: June 2013. Table 19.

24Cornell

University Legal Information Institute summarizes these claims citing

Dodd-Frank, Title II, Sec. 209 (b): “Claims are paid in the following

order: (1) administrative costs; (2) the government; (3) wages,

salaries, or commissions of employees; (4) contributions to employee

benefit plans; (5) any other general or senior liability of the company;

(6) any junior obligation; (7) salaries of executives and directors of

the company; and (8) obligations to shareholders, members, general

partners, and other equity holders.”

For a PDF of this document click here.

Related articles

- Video Taping Is Encouraged By Most U.S. Citizens Employed As police: Federal Court Rules Videoing Police Protected By U.S. Constitution!

- Three years of Dodd-Frank’s broken promises

- John Birch Society Organized To Counter Rothschild’s Corrupt Council On Foreign Relations!

- Fed’s Lacker: Dodd-Frank May Not Curtail Emergency Powers

- Dodd-Frank’s Mass Murder Mandate Is Treason: Crush It! (thepeoplesvoice.org)

- How Free Americans Became Slaves To The Rothschild Bankers: Glass Steagall Act Will Stop Them ~ You Know, The One Billy Clinton Repealed In 1999 That Allowed The Housing Bubble!

- Voices On Both Sides of the Atlantic Call for Restoring Glass-Steagall

Dodd-Frank And Wall Street Has Never Been More Corrupt

Dodd-Frank And Wall Street Has Never Been More Corrupt- Roman Catholic Pope Benedict XVI: Earth’s Ecosystem Damaged By Rothschild Hoarding And Not By Healthy Carbon Dioxide!

- Obama’s Secrets And Lies Of The Bailouts: Tarp Ceiling Was Secretly Raised 117 Times ~ RollingStone

- Breaking => U.S. Citizens Stuck With Billions In Obama Orchestrated TARP Losses: States Must Nullify The Printed Paper Bailout ~ TARP Ceiling Was Raised 117 Times From $787 Billion To A Hidden $12.8 Trillion!

- RollingStone The Fed’s aka; Rothschild’s Magic Money-Printing Machine: Usurping U.S. Gold Backed Currency!

- ROLLING STONE : ROTHSCHILD CORRUPTION GOES MAINSTREAM

- ROLLING STONE: “Conspiracy Theorists Of The World, Believers In The Hidden Hands Of The Rothschilds, We Skeptics Owe You An Apology.”

![THIS IS WHAT IS ACTUALLY TAKING PLACE RIGHT NOW! NIXON ILLEGALLY DROPPED OUR GOLD BACKING FOR ROTHSCHILD TO PILFER THE U.S. WITH PAPER. NOW THAT THE U.S. IS SMOTHERED WITH FORCED PAPER [ARTIFICIAL] DEBT ~ ROTHSCHILD HAS BEEN [MERGING] THE GOLD FROM LIBYA TO HIS VAULTS. ONE OF ROTHSCHILD'S VAULTS IS NOW BAGHDAD. THIS IS WHY ROTHSCHILD'S COMEX HAS ALSO BEEN ARTIFICIALLY DUMPING THE GOLD/SILVER CHARTS -> TO GET PEOPLE OUT OF THE GOLD/SILVER MARKET -> JUST REMEMBER SILVER IS 5Xs MORE SCARCE THAN GOLD AND INDUSTRY USES SILVER FAR MORE SO THAN GOLD. JUST WAIT UNTIL THE BOTTOM IS HIT ON THIS ONE ~ THE PRECIOUS METALS MARKET WILL SKY ROCKET INTO INFINITY AND THOSE MESMERIZED BY FOOTBALL GAMES AND PARIS HILTON WILL BE EATING CAT FOOD IN THE ALLEYS I AM VERY SORRY TO SAY THIS IS THE ELITIST GAME AND THATS HOW THESE SOCIOPATHS THINK AND THIS IS ALSO HOW WE AMERICANS GAVE UP ON OUT THINKING THESE VIGILANT PARASITES. ~ Click To Enlarge ~](http://rasica.files.wordpress.com/2013/04/bank-oligarchy-green.jpg?w=594)

THIS

IS WHAT IS ACTUALLY TAKING PLACE RIGHT NOW! NIXON ILLEGALLY DROPPED OUR

GOLD BACKING FOR ROTHSCHILD TO PILFER THE U.S.

WITH PAPER.

~ Click To Enlarge ~

~ Click To Enlarge ~

NOW THAT THE U.S. IS SMOTHERED WITH FORCED PAPER [ARTIFICIAL] DEBT ~

ROTHSCHILD HAS BEEN [MERGING] THE GOLD FROM LIBYA TO HIS VAULTS.

ONE OF ROTHSCHILD’S VAULTS IS NOW BAGHDAD.

THIS IS WHY ROTHSCHILD’S COMEX HAS ALSO BEEN ARTIFICIALLY DUMPING THE GOLD/SILVER CHARTS ->

JUST REMEMBER SILVER IS 5Xs MORE SCARCE THAN GOLD AND INDUSTRY USES SILVER FAR MORE SO THAN GOLD.

JUST WAIT UNTIL THE BOTTOM IS HIT ON THIS ONE ~ THE PRECIOUS METALS MARKET WILL SKY ROCKET INTO INFINITY AND THOSE MESMERIZED BY FOOTBALL GAMES AND PARIS HILTON WILL BE EATING CAT FOOD IN THE ALLEYS.

I AM VERY SORRY TO SAY THIS BUT IT IS TRUE -> THIS IS THE ELITIST GAME AND THATS HOW THESE SOCIOPATHS THINK & ACT!

THIS IS ALSO HOW WE AMERICANS GAVE UP ON THINKING AND THIS IS THE M.O. OF THESE VIGILANT PARASITES.

~ ITS ALL A GAME TO THEM BECAUSE THEY HAVE BOUGHT THE PICK & CHOOSE ESTABLISHED LAW FOR THEMSELVES ~~ BUT IT IS LIFE & DEATH TO US! ~U.S. Republic Militias

Whistleblower

No comments:

Post a Comment